Investment Analyst Job Description: Skills, Duties and Career Outlook

What does an investment analyst do? Learn about the investment analyst job description, main duties and responsibilities, skills and requirements needed, and career advancement.

What is an Investment Analyst?

- Analyzes financial data to recommend buying, selling or holding stocks and other securities

- Specializes in researching specific industries, types of securities, or geographic regions

- Aims to predict the performance of investments to maximize returns

- Works for banks, hedge funds, wealth managers, pension funds, insurance firms, etc.

Investment Analyst Duties and Responsibilities

Core Functions

- Research: Analyze companies, markets, industries, and economic trends

- Financial Modeling: Project future revenues, expenses, and earnings in models

- Valuation: Assess the fair value of securities to spot over/underpricing

- Reporting: Write research reports with ratings, targets and themes

- Monitoring: Follow current portfolios, news for opportunities and risks

Day-to-Day Tasks

- Obtain and verify relevant data from SEC filings, earnings calls, trade publications

- Develop and test assumptions using analytical and quantitative techniques

- Present findings to fund managers, clients and investor relations teams

- Build and maintain financial models detailing various growth scenarios

- Formulate investment theses aligned with economic outlook and sector performance

Skills and Qualifications for Investment Analysts

Education

- Bachelor’s degree in finance, economics, or business; Master’s degree optional

Key Competencies

- Financial modelling and analysis

- Research and valuation skills

- Written and verbal communication abilities

- Understanding of global markets and securities

Certifications

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Chartered Market Technician (CMT)

- Chartered Alternative Investment Analyst (CAIA)

Soft Skills

- Attention to detail

- Quantitative skills

- Creative and critical thinking

- Teamwork and collaboration

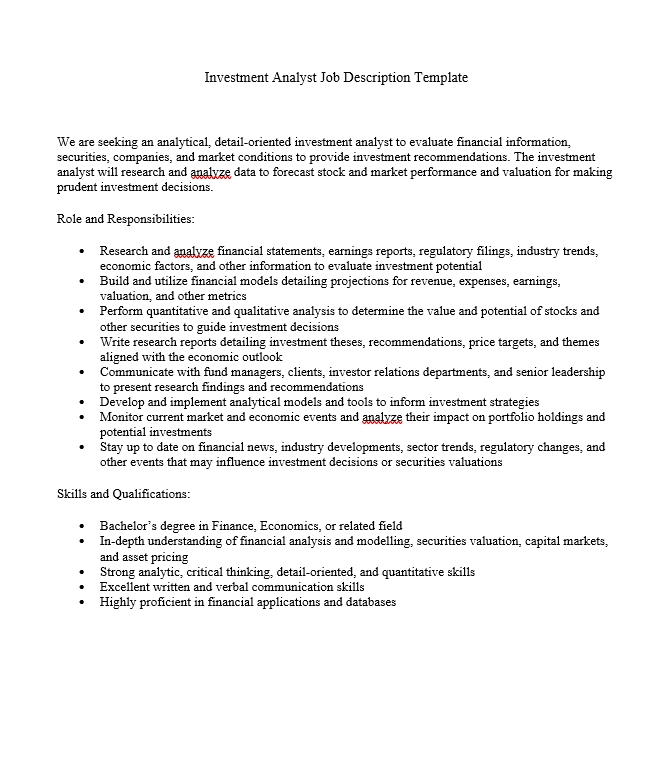

Investment Analyst Job Description Template

We are seeking an analytical, detail-oriented investment analyst to evaluate financial information, securities, companies, and market conditions to provide investment recommendations. The investment analyst will research and analyze data to forecast stock and market performance and valuation for making prudent investment decisions.

Role and Responsibilities:

- Research and analyze financial statements, earnings reports, regulatory filings, industry trends, economic factors, and other information to evaluate investment potential

- Build and utilize financial models detailing projections for revenue, expenses, earnings, valuation, and other metrics

- Perform quantitative and qualitative analysis to determine the value and potential of stocks and other securities to guide investment decisions

- Write research reports detailing investment theses, recommendations, price targets, and themes aligned with the economic outlook

- Communicate with fund managers, clients, investor relations departments, and senior leadership to present research findings and recommendations

- Develop and implement analytical models and tools to inform investment strategies

- Monitor current market and economic events and analyze their impact on portfolio holdings and potential investments

- Stay up to date on financial news, industry developments, sector trends, regulatory changes, and other events that may influence investment decisions or securities valuations

Skills and Qualifications:

- Bachelor’s degree in Finance, Economics, or related field

- In-depth understanding of financial analysis and modelling, securities valuation, capital markets, and asset pricing

- Strong analytic, critical thinking, detail-oriented, and quantitative skills

- Excellent written and verbal communication skills

- Highly proficient in financial applications and databases

What does an investment analyst do?

An investment analyst researches and evaluates financial information, market trends, economic factors, and specific securities to recommend investment decisions. Their analysis and models aim to predict performance to maximize returns.

What are the main duties of an investment analyst?

- Research companies, industries, markets and economic conditions

- Build financial models projecting revenues, expenses, valuations

- Perform quantitative and qualitative security analysis

- Write research reports with ratings, targets, and investment themes

- Present findings to fund managers and investors

- Monitor current holdings and markets for new developments

What skills does an investment analyst need?

Investment analysts need skills in research, financial modelling/analysis, valuation techniques, writing, presentation and communication, and quantitative methods. Strong critical thinking and attention to detail are also crucial.

What degree do you need to be an investment analyst?

A bachelor’s degree in finance, economics, or business is required. Many analysts pursue a master’s degree or professional certifications like the CFA, CFP or CMT.

What is the career outlook for investment analysts?

Employment of investment analysts is projected to grow 10 per cent from 2021 to 2031, faster than the average across all occupations. A growing range of financial products and need for guidance on investing should drive demand.

Do investment analysts make good money?

Yes, investment analyst salaries average approximately $97,000 per year. With experience and certifications, analysts at top firms can make over $150,000 annually.