Tax Accountant Job Description

Tax accountants are responsible for ensuring their clients comply with tax laws and regulations. They work with a wide range of clients, including individuals, small businesses, large corporations, and non-profit organizations. One of their jobs is to prepare and file tax returns, plan and analyze taxes, and talk to clients and other interested parties.

Tax Accountant Responsibilities

The specific responsibilities of tax accountants can vary depending on their client’s needs. However, some common responsibilities include:

Preparing and filing tax returns: Tax accountants help their clients prepare and file tax returns, making sure they follow all tax laws and rules.

Tax planning and analysis: Tax accountants help their clients plan their tax strategies so that they pay the least amount of taxes possible. This may involve analyzing financial statements, identifying tax-saving opportunities, and recommending tax-efficient investment strategies.

Communicating with clients and other stakeholders: Tax accountants work closely with clients to understand their tax needs and ensure their compliance with tax laws and regulations. They also talk to other interested parties, like auditors and regulatory agencies, to make sure that reporting requirements are met.

Staying up-to-date with tax laws and regulations: Tax laws and regulations are constantly changing, so tax accountants must stay up-to-date with these changes to ensure their clients remain compliant.

Tax Accountant Requirements and Skills

Most people need a degree in accounting or a related field to work as a tax accountant. In this field, professional certifications like the Certified Public Accountant (CPA) designation are also very important. In addition to these educational requirements, tax accountants need both technical and soft skills to succeed in their roles.

Technical skills: Tax accountants must have a strong understanding of tax laws and regulations, as well as proficiency in tax software. They should also have strong analytical and mathematical skills.

Soft skills: Tax accountants must be able to communicate effectively with clients and other stakeholders. They should have strong attention to detail and be able to work well under pressure.

How to Become a Tax Accountant

To become a tax accountant, individuals typically need to earn a degree in accounting or a related field. They may also need to complete a certain number of credit hours in tax-related coursework. Professional certifications, such as the CPA designation, are also highly valued in this field.

Gaining experience through internships or entry-level positions is also important for aspiring tax accountants. People can improve their skills and learn about different parts of tax accounting through these chances.

People can also move up in their careers as tax accountants by making connections and learning new things. Joining professional groups and going to conferences and seminars can be great ways to learn and connect with other professionals in your field.

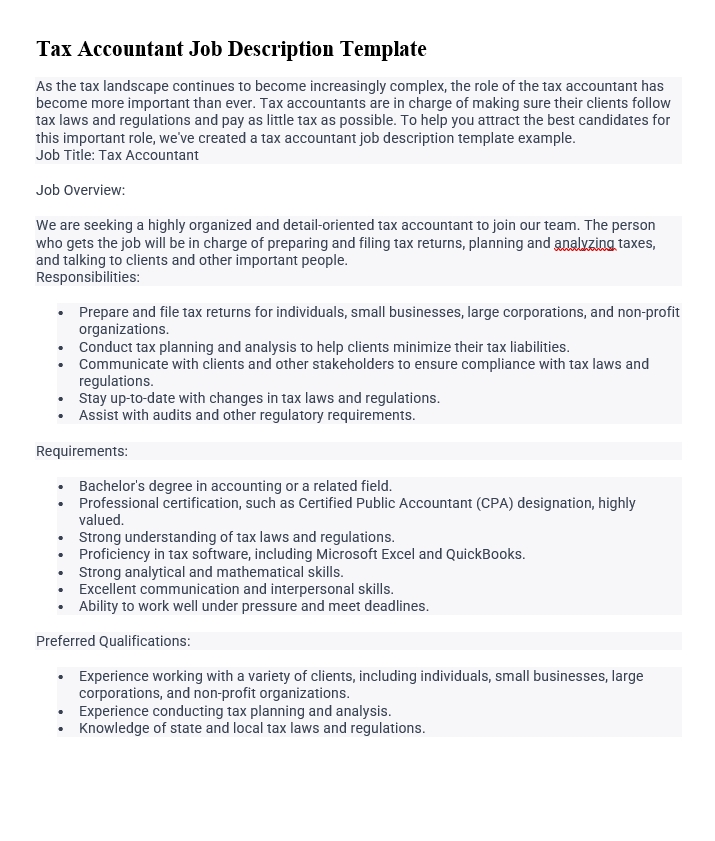

Tax Accountant Job Description Template

As the tax landscape continues to become increasingly complex, the role of the tax accountant has become more important than ever. Tax accountants are in charge of making sure their clients follow tax laws and regulations and pay as little tax as possible. To help you attract the best candidates for this important role, we’ve created a tax accountant job description template example.

Job Title: Tax Accountant

Job Overview:

We are seeking a highly organized and detail-oriented tax accountant to join our team. The person who gets the job will be in charge of preparing and filing tax returns, planning and analyzing taxes, and talking to clients and other important people.

Responsibilities:

- Prepare and file tax returns for individuals, small businesses, large corporations, and non-profit organizations.

- Conduct tax planning and analysis to help clients minimize their tax liabilities.

- Communicate with clients and other stakeholders to ensure compliance with tax laws and regulations.

- Stay up-to-date with changes in tax laws and regulations.

- Assist with audits and other regulatory requirements.

Requirements:

- Bachelor’s degree in accounting or a related field.

- Professional certification, such as Certified Public Accountant (CPA) designation, highly valued.

- Strong understanding of tax laws and regulations.

- Proficiency in tax software, including Microsoft Excel and QuickBooks.

- Strong analytical and mathematical skills.

- Excellent communication and interpersonal skills.

- Ability to work well under pressure and meet deadlines.

Preferred Qualifications:

- Experience working with a variety of clients, including individuals, small businesses, large corporations, and non-profit organizations.

- Experience conducting tax planning and analysis.

- Knowledge of state and local tax laws and regulations.

If you’re considering a career as a tax accountant, you likely have some questions about the job. To help you better understand this role, we’ve compiled some frequently asked questions (FAQs) about tax accountants.

Q: What does a tax accountant do?

A: Tax accountants are in charge of preparing and filing tax returns, planning and analyzing taxes, and making sure that tax laws and rules are followed. They work with individuals, small businesses, large corporations, and non-profit organizations to help minimize tax liabilities while ensuring compliance with tax laws.

Q: What qualifications do I need to become a tax accountant?

A: Most tax accountant positions require a bachelor’s degree in accounting or a related field. Professional certification, such as a Certified Public Accountant (CPA) designation, is highly valued. Also, you must have strong analytical and math skills, know how to use tax software, and have good communication and people skills.

Q: What is the salary range for tax accountants?

A: The salary range for tax accountants varies depending on factors such as experience, location, and industry. According to the Bureau of Labor Statistics, the median annual wage for accountants and auditors was $73,560 as of May 2020.

Q: What are the career growth opportunities for tax accountants?

A: Tax accountants can move up to jobs like tax manager, senior tax accountant, or tax director as they gain experience and get more education or certifications. Some tax accountants may also choose to start their own accounting firms or consultancies.

Q: What are the biggest challenges facing tax accountants today?

A: One of the biggest challenges facing tax accountants today is keeping up with the constantly changing tax laws and regulations. This requires ongoing education and training to stay current on the latest developments. Additionally, the growing complexity of tax laws and regulations can make it difficult to ensure compliance while minimizing tax liabilities for clients.

Q: What skills are important for success as a tax accountant?

A: To be successful as a tax accountant, you need to be good at math and analysis, know how to use tax software, and have good communication and people skills. Additionally, attention to detail, organization, and the ability to work well under pressure and meet deadlines are important traits for this role.