As businesses grow, so do their employees, and with that comes the need for someone to handle the payroll. This is where the payroll specialist comes in. In this article, we’ll talk about everything you need to know about being a payroll specialist, including their job description, responsibilities, and the requirements and skills they need to do this important job well in any organization.

Job Description

A payroll specialist is responsible for managing the payroll process for an organization. They ensure that employees are paid accurately and on time and that all payroll-related taxes and deductions are processed correctly. They also maintain accurate employee payroll records and respond to employee inquiries regarding payroll.

Responsibilities

Depending on the company, a payroll specialist’s tasks can be different, but they usually include the following:

Handling Employee Payroll Records

As a payroll specialist, it is your job to keep accurate records of the hours worked, wages earned, and taxes paid by each employee.

Managing Employee Timekeeping Records

Payroll specialists also manage employee timekeeping records to ensure that employees are being paid accurately for the time they work.

Calculating and Processing Payroll Taxes and Deductions

Payroll specialists are in charge of figuring out and taking care of all taxes and deductions from paychecks. This includes federal and state taxes, social security, Medicare, and any other deductions that apply.

Ensuring Compliance with Federal and State Regulations

Payroll specialists have to make sure that their company follows all federal and state rules about payroll, such as tax laws, labor laws, and wage and hour rules.

Responding to Employee Inquiries Regarding Payroll

Payroll specialists are the go-to people for any payroll-related employee questions. They must be knowledgeable about the payroll process and be able to answer any questions employees may have.

Requirements and Skills

To become a payroll specialist, there are certain requirements and skills that employers typically look for:

Education and Certification Requirements

Even though most jobs require a high school diploma or the equivalent, some employers may prefer applicants with an associate’s or bachelor’s degree in accounting, finance, or a related field. Certification from a professional organization, such as the American Payroll Association, is also a plus.

Experience Requirements

Employers typically look for candidates with experience in payroll or a related field. This could include experience in accounting, bookkeeping, or human resources.

Technical Skills Required

Payroll specialists must be proficient in payroll software and spreadsheet programs. They must also have a good understanding of accounting principles and be able to calculate taxes and deductions accurately.

Soft Skills Required

Payroll specialists need to be able to talk to employees and answer their questions, so they need to be good at communicating. They must also have strong attention to detail to ensure that all payroll records and calculations are accurate. To find and fix any problems with payroll, you also need to be able to think analytically. may arise.

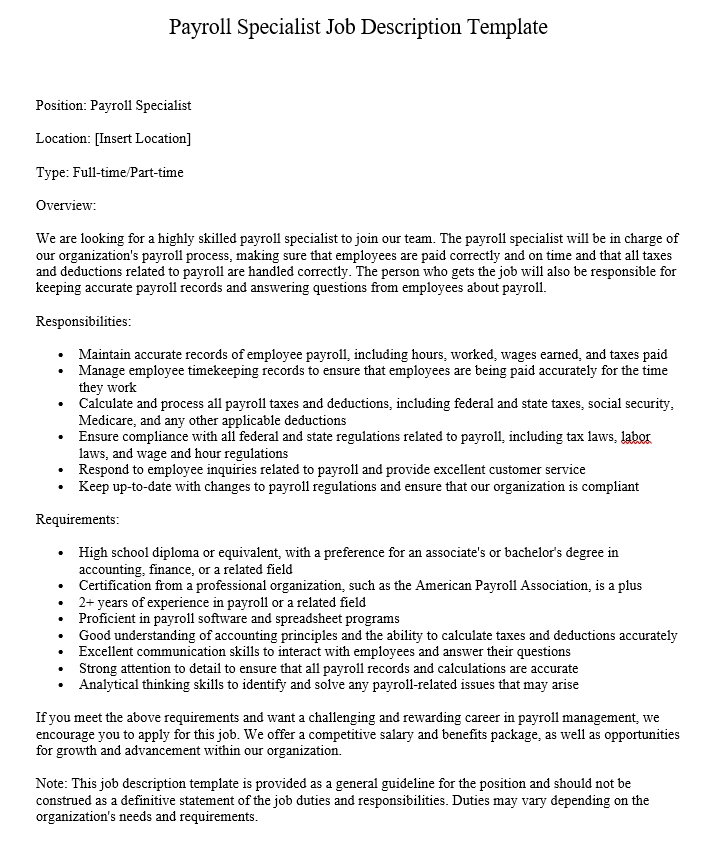

Payroll Specialist Job Description Template

Position: Payroll Specialist

Location: [Insert Location]

Type: Full-time/Part-time

Overview:

We are looking for a highly skilled payroll specialist to join our team. The payroll specialist will be in charge of our organization’s payroll process, making sure that employees are paid correctly and on time and that all taxes and deductions related to payroll are handled correctly. The person who gets the job will also be responsible for keeping accurate payroll records and answering questions from employees about payroll.

Responsibilities:

- Maintain accurate records of employee payroll, including hours, worked, wages earned, and taxes paid

- Manage employee timekeeping records to ensure that employees are being paid accurately for the time they work

- Calculate and process all payroll taxes and deductions, including federal and state taxes, social security, Medicare, and any other applicable deductions

- Ensure compliance with all federal and state regulations related to payroll, including tax laws, labor laws, and wage and hour regulations

- Respond to employee inquiries related to payroll and provide excellent customer service

- Keep up-to-date with changes to payroll regulations and ensure that our organization is compliant

Requirements:

- High school diploma or equivalent, with a preference for an associate’s or bachelor’s degree in accounting, finance, or a related field

- Certification from a professional organization, such as the American Payroll Association, is a plus

- 2+ years of experience in payroll or a related field

- Proficient in payroll software and spreadsheet programs

- Good understanding of accounting principles and the ability to calculate taxes and deductions accurately

- Excellent communication skills to interact with employees and answer their questions

- Strong attention to detail to ensure that all payroll records and calculations are accurate

- Analytical thinking skills to identify and solve any payroll-related issues that may arise

If you meet the above requirements and want a challenging and rewarding career in payroll management, we encourage you to apply for this job. We offer a competitive salary and benefits package, as well as opportunities for growth and advancement within our organization.

Note: This job description template is provided as a general guideline for the position and should not be construed as a definitive statement of the job duties and responsibilities. Duties may vary depending on the organization’s needs and requirements.

FAQ: Payroll Specialist Job

Q: What is a payroll specialist?

A: A payroll specialist is responsible for managing an organization’s payroll process, including processing employee payments, calculating and processing payroll taxes and deductions, and maintaining accurate payroll records.

Q: What are the responsibilities of a payroll specialist?

A: A payroll specialist is in charge of the whole payroll process, from making sure employees are paid correctly and on time to taking care of taxes and deductions related to payroll. They also keep accurate payroll records for employees and answer questions from employees about payroll.

Q: What skills are required to become a payroll specialist?

A: A payroll specialist should have a good understanding of accounting principles, as well as the ability to calculate taxes and deductions accurately. They should also be able to communicate well with employees and answer their questions. They should pay close attention to detail to make sure that all payroll records and calculations are correct, and they should be able to think analytically to find and solve any problems that may come up with payroll.

Q: What education is required to become a payroll specialist?

A: A high school diploma or equivalent is usually required, with a preference for an associate’s or bachelor’s degree in accounting, finance, or a related field. Certification from a professional organization, such as the American Payroll Association, is also a plus.

Q: What is the salary range for a payroll specialist?

A: The salary range for a payroll specialist can vary depending on the location, organization, and level of experience. According to the Bureau of Labor Statistics, the median annual wage for payroll specialists in the United States is $48,500.

Q: What are the career opportunities for a payroll specialist?

A: A payroll specialist can advance their career by taking on more responsibilities within the payroll department, such as becoming a payroll manager or supervisor. They can also look into opportunities in other areas of finance and accounting, such as becoming an accountant or a financial analyst.

Q: What are the benefits of working as a payroll specialist?

A: Working as a payroll specialist can be a rewarding career with opportunities for growth and advancement. It also gives the satisfaction of making sure that employees are paid correctly and on time, which is important to their overall job satisfaction. Additionally, many organizations offer competitive salary and benefits packages for payroll specialists.