Payroll Manager Job Description

As a payroll manager, your main job is to oversee the whole payroll process. This includes processing employee paychecks, keeping track of how many hours each employee worked, and figuring out taxes and other deductions. Also, you must make sure to follow all relevant laws and rules, such as those about the minimum wage, overtime, and taxes.

In this position, you’ll be in charge of giving accurate payroll reports and analyses to senior management while keeping things professional and private. You’ll also be responsible for keeping payroll records that are correct and complete. These records may be audited.

Payroll Manager Responsibilities

The payroll manager’s main responsibilities include:

Managing the Payroll Process: As a payroll manager, you’ll be responsible for managing the entire payroll process, from collecting employee timecards to processing paychecks and taxes. This means checking time cards, figuring out pay and deductions, and processing direct deposits or checks.

Ensuring Compliance with Laws and Regulations: You must stay up to date with all relevant laws and regulations, including tax laws, minimum wage laws, and overtime regulations. You must ensure that the organization is in compliance with all of these laws, and that employee pay and benefits are accurate and in compliance.

Overseeing Benefits Administration: You may be responsible for overseeing employee benefits administration, including health insurance, 401(k) plans, and other employee benefits. This includes ensuring that employees are enrolled in the correct plans, that the organization is paying its share of the premiums, and that all benefits information is accurately recorded.

Keeping Good Records: You must keep accurate and complete records of your employees’ pay, taxes, and benefits, as well as their pay, taxes, and benefits. These records may be subject to audits, so accuracy and attention to detail are essential.

Responding to Employee Questions: You must answer employee questions about pay, benefits, taxes, and the like. You must be able to answer questions accurately and professionally and ensure that employee inquiries are resolved in a timely manner.

Creating and Putting in Place Payroll Policies and Procedures: You may be in charge of creating and putting in place payrolls policies and procedures, like pay schedules and ways to turn in time cards. You must ensure that these policies are in compliance with laws and regulations and that they are communicated effectively to all employees.

Giving Payroll Reports to Management: You must give accurate and timely payroll reports and analyses to senior management, such as budget and forecasting reports, payroll tax reports, and other financial reports.

Payroll Manager Requirements and Skills

To become a payroll manager, you must have a bachelor’s degree in finance, accounting, or a related field. You must also have at least five years of experience with managing payroll, as well as with managing benefits and making sure that laws and rules are followed.

Professional certifications like the Certified Payroll Professional (CPP) or the Fundamental Payroll Certification (FPC) are also very valuable. Technical skills like knowing how to use payroll software and spreadsheets well are important, as are social skills like being able to communicate and lead.

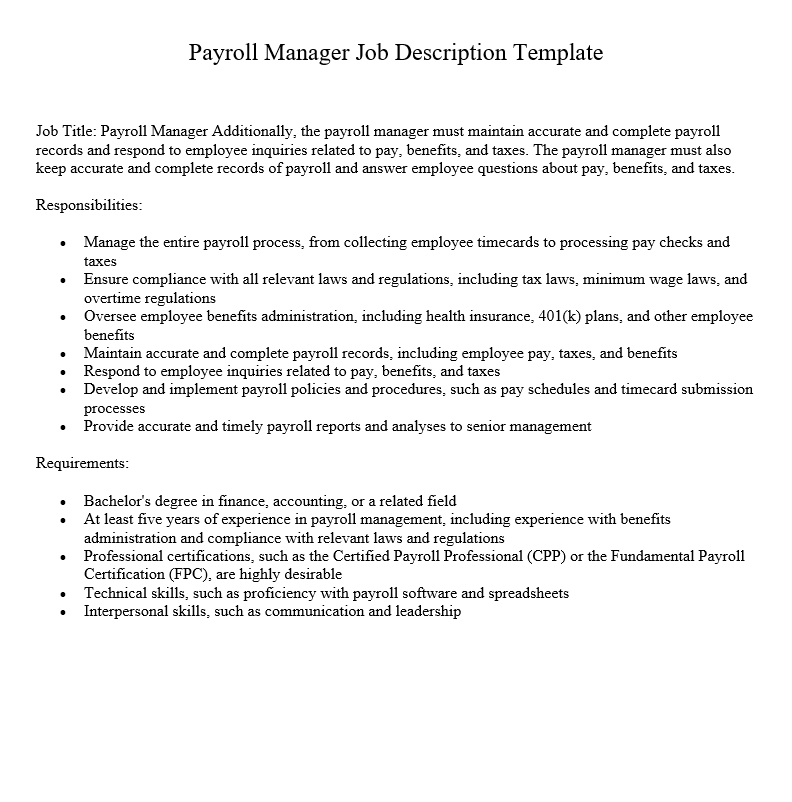

Payroll Manager Job Description Template

Job Title: Payroll ManagerAdditionally, the payroll manager must maintain accurate and complete payroll records and respond to employee inquiries related to pay, benefits, and taxes. The payroll manager must also keep accurate and complete records of payroll and answer employee questions about pay, benefits, and taxes.

Responsibilities:

- Manage the entire payroll process, from collecting employee timecards to processing paychecks and taxes

- Ensure compliance with all relevant laws and regulations, including tax laws, minimum wage laws, and overtime regulations

- Oversee employee benefits administration, including health insurance, 401(k) plans, and other employee benefits

- Maintain accurate and complete payroll records, including employee pay, taxes, and benefits

- Respond to employee inquiries related to pay, benefits, and taxes

- Develop and implement payroll policies and procedures, such as pay schedules and timecard submission processes

- Provide accurate and timely payroll reports and analyses to senior management

Requirements:

- Bachelor’s degree in finance, accounting, or a related field

- At least five years of experience in payroll management, including experience with benefits administration and compliance with relevant laws and regulations

- Professional certifications, such as the Certified Payroll Professional (CPP) or the Fundamental Payroll Certification (FPC), are highly desirable

- Technical skills, such as proficiency with payroll software and spreadsheets

- Interpersonal skills, such as communication and leadership

FAQ: Payroll Manager Job

Q: What is a payroll manager?

A payroll manager is a person in charge of making sure that an organization’s payroll runs smoothly. This means collecting employee timesheets, processing paychecks and taxes, and keeping accurate payroll records. They are in charge of making sure that all laws and rules are followed, as well as giving accurate payroll reports and analyses to senior management.

Q: What are the essential responsibilities of a payroll manager?

A: A payroll manager’s most important jobs are to manage the whole payroll process, make sure all laws and rules are followed, oversee the administration of employee benefits, keep accurate payroll records, answer employee questions about pay, benefits, and taxes, create and implement payroll policies and procedures, and give accurate and timely payroll reports and analysis to senior management.

Q: What qualifications are required to become a payroll manager?

A: Typically, a payroll manager must have a bachelor’s degree in finance, accounting, or a related field and at least five years of payroll management experience. The Certified Payroll Professional (CPP) and the Fundamental Payroll Certification (FPC) are both valuable professional certifications. In addition, interpersonal skills including communication and leadership, as well as technical skills such as proficiency with payroll software and spreadsheets, are required.

Q: What are the benefits of hiring a payroll manager?

A: Hiring a payroll manager can bring several benefits to an organization. First, they can make sure that the organization follows all laws and rules, so that there are no legal or financial consequences. Second, they can make sure that employees are paid correctly and on time, which makes employees happier and more likely to stay with the company. Lastly, they can give accurate payroll reports and analyses to senior management, which helps them make better decisions and plan their finances.

Q: What are the challenges of being a payroll manager?

A: Some of the challenges of being a payroll manager are managing complicated payroll processes, staying up to date on changes to tax laws and rules, answering questions from employees about payroll, and making sure data is secure and private. Additionally, payroll managers may face challenges related to managing employee expectations regarding pay and benefits and communicating effectively with senior management about payroll-related matters.

Q: How can a payroll manager improve an organization’s payroll processes?

A: A payroll manager can improve an organization’s payroll processes by putting in place efficient and accurate payroll systems and procedures, making sure all relevant laws and rules are followed, training and helping employees with payroll-related issues on an ongoing basis, and using data analytics to find places to improve and make decisions based on the data. Also, they can work with other departments, like HR and accounting, to make sure that payroll processes and other organizational functions work together smoothly.