Investment Banker Job Description: Skills, Responsibilities and Requirements

Investment banking offers intellectually stimulating work for those interested in finance and the markets. This in-depth guide covers everything you need to know about succeeding in this fast-paced industry.

Investment Banker Job Description

An investment banker is a financial advisor who:

- Helps companies, governments, and other groups raise money via debt and equity offerings

- Advises on mergers, acquisitions, and corporate restructuring

They work at boutique firms focused on particular industries or geographies, as well as bulge bracket banks offering full-service banking globally.

Core Investment Banking Responsibilities

- Financial Modeling: Building valuation models, financial projections and other analysis to quantify transactions and performance

- Client Interactions: Developing materials to communicate recommendations and advise clients

- Execution: Managing processes to complete transactions like IPOs or mergers

Key Investment Banker Responsibilities

Investment bankers have three primary areas of responsibility:

Financial Modeling and Analysis

- Construct detailed financial models in Excel to value companies in potential transactions

- Perform in-depth due diligence research on acquisition targets or securities issuers

- Create presentations outlining quantitative and qualitative analyses

Client Interactions

- Foster relationships with firm executives like CEOs and CFOs

- Clearly communicate complex financial information to clients

- Tailor analysis and recommendations for client capital needs

Execution

- Manage fast-paced processes for security issuances and M&A deals

- Prepare regulatory documentation like S-1 registration statements

- Coordinate internal and external parties to successfully close transactions

Investment Banker Requirements

To secure a career in investment banking, candidates require:

Education

- Bachelor’s degree; finance, accounting or business preferred

- A Master of Business Administration (MBA) advantageous

Key Technical Skills

- Excellence in financial accounting and corporate finance knowledge

- Expertise in Excel financial modeling

- Strong financial analysis abilities

Critical Soft Skills

- Communication and interpersonal aptitudes

- Intellectual curiosity and problem-solving

- Attention to detail and data accuracy

- Ability to manage complex tasks under tight deadlines

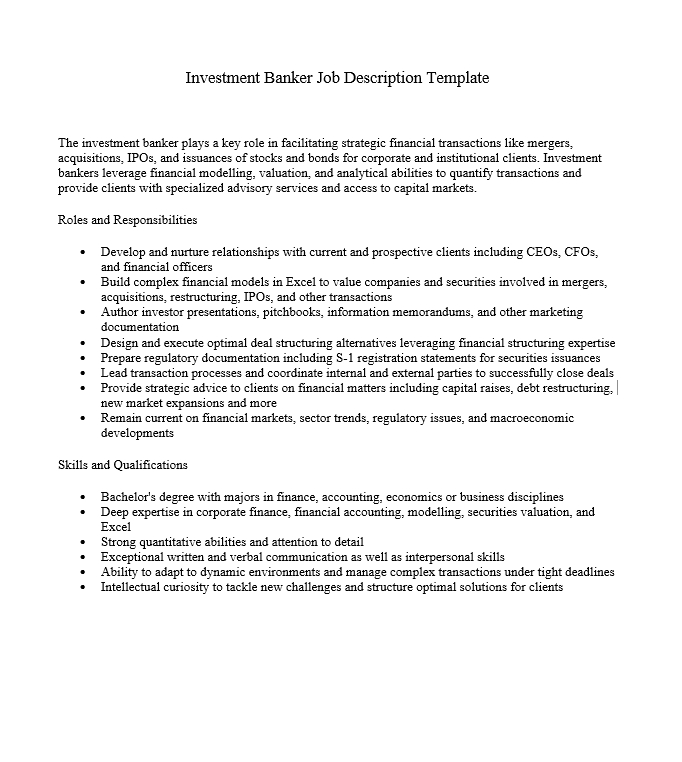

Investment Banker Job Description Template

The investment banker plays a key role in facilitating strategic financial transactions like mergers, acquisitions, IPOs, and issuances of stocks and bonds for corporate and institutional clients. Investment bankers leverage financial modelling, valuation, and analytical abilities to quantify transactions and provide clients with specialized advisory services and access to capital markets.

Roles and Responsibilities

- Develop and nurture relationships with current and prospective clients including CEOs, CFOs, and financial officers

- Build complex financial models in Excel to value companies and securities involved in mergers, acquisitions, restructuring, IPOs, and other transactions

- Author investor presentations, pitchbooks, information memorandums, and other marketing documentation

- Design and execute optimal deal structuring alternatives leveraging financial structuring expertise

- Prepare regulatory documentation including S-1 registration statements for securities issuances

- Lead transaction processes and coordinate internal and external parties to successfully close deals

- Provide strategic advice to clients on financial matters including capital raises, debt restructuring, new market expansions and more

- Remain current on financial markets, sector trends, regulatory issues, and macroeconomic developments

Skills and Qualifications

- Bachelor’s degree with majors in finance, accounting, economics or business disciplines

- Deep expertise in corporate finance, financial accounting, modelling, securities valuation, and Excel

- Strong quantitative abilities and attention to detail

- Exceptional written and verbal communication as well as interpersonal skills

- Ability to adapt to dynamic environments and manage complex transactions under tight deadlines

- Intellectual curiosity to tackle new challenges and structure optimal solutions for clients

An investment banking career offers opportunities to work on large financial transactions and strategic projects. If you are interested in this fast-paced profession, consider some of these commonly asked questions:

What does an investment banker do?

Investment bankers help companies, governments and institutions raise capital and provide strategic financial advice. My main responsibilities include building financial models, preparing marketing materials for deals, developing investor presentations and managing transaction execution.

What skills does an investment banker need?

Excellence in financial modelling in Excel along with corporate valuation and securities analysis skills are must-haves. You also need to have strong quantitative abilities, communication skills, intellectual curiosity and the capacity to manage high-pressure deals under tight deadlines.

How stressful are the hours as an investment banker?

The hours can be gruelling, especially at large firms. Expect frequent weekend work and 80-100 hours during particularly busy transaction weeks. However, the work itself is very dynamic and intellectually stimulating.

What is the career path like in investment banking?

Early career investment bankers often start as analysts before progressing into associates, then vice presidents and ultimately director-plus roles over 7-10 years. Some pursue other opportunities like private equity, and hedge funds or start their firms later on.

How much do investment bankers get paid?

First-year analyst salaries at top firms typically start around $100k-$150k with bonuses. This can rise to over $500k+ in compensation for managing directors at bulge bracket banks.

What major should I choose for investment banking?

Finance, accounting, economics and mathematics majors are best to prepare you for the technical nature of the work. Computer science or engineering majors can also succeed with sufficient financial coursework and financial modelling skills.