CPA Job Description

As a CPA, you will be responsible for a variety of financial tasks, such as making and analyzing financial statements, providing auditing and assurance services, tax planning and compliance, and consulting services. Depending on where you work, such as in public accounting firms, government agencies, corporations, or non-profit organizations, the details of your job will be different.

Here’s a breakdown of the primary responsibilities of a CPA:

Preparing and analyzing financial statements:

- Creating financial statements, such as income statements, balance sheets, and cash flow statements, using accounting software and other tools

- Analyzing financial data to identify trends and areas for improvement

- Ensuring financial statements comply with accounting standards

Auditing and assurance services:

- Conducting audits to verify the accuracy and completeness of financial statements

- Providing assurance services, such as reviews and compilations, to ensure compliance with accounting standards

- Identifying areas of risk and making recommendations to improve internal controls

Tax planning and compliance:

- Helping clients manage their tax obligations through tax planning and compliance services

- Minimizing clients’ tax liability while ensuring compliance with tax laws and regulations

- Keeping up-to-date with changes in tax laws and regulations that may impact clients

Consulting services:

- Providing strategic advice to clients on financial and business matters

- Developing and implementing financial plans

- Identifying areas for growth and improvement

CPA Responsibilities:

To be successful as a CPA, you’ll need both technical and soft skills. Here are some of the key responsibilities of a CPA:

Attention to detail:

- Spotting errors and inconsistencies in financial statements

- Ensuring accuracy and completeness of financial data

Analytical skills:

- Analyzing financial data to identify trends and insights

- Interpreting financial information to provide meaningful recommendations

Communication skills:

- Communicating financial information to clients, stakeholders, and other professionals

- Writing reports and making presentations to communicate findings and recommendations

Ethics and integrity:

- Adhering to high ethical standards and demonstrating integrity in all professional activities

- Ensuring client confidentiality and privacy

CPA Requirements and Skills:

To become a CPA, you’ll need to meet certain education and certification requirements. Here are some of the key requirements and skills needed to succeed as a CPA:

Education and certification requirements:

- A bachelor’s degree in accounting or a related field

- Passing the Uniform CPA Exam

- Completing a certain number of hours of continuing education each year to maintain certification

Technical skills:

- Proficiency in accounting software, such as QuickBooks and Excel

- Knowledge of tax laws and regulations

- Understanding of financial statements and accounting principles

Soft skills:

- Attention to detail

- Analytical skills

- Communication skills

- Ethics and integrity

Advantages and Challenges of Pursuing a CPA Career:

While a CPA career can be rewarding, it also comes with its own set of advantages and challenges. Here are a few to consider:

Advantages:

- Opportunities for career growth and development

- Competitive salary and benefits

- Work-life balance and stress management

- Ongoing learning and professional development requirements

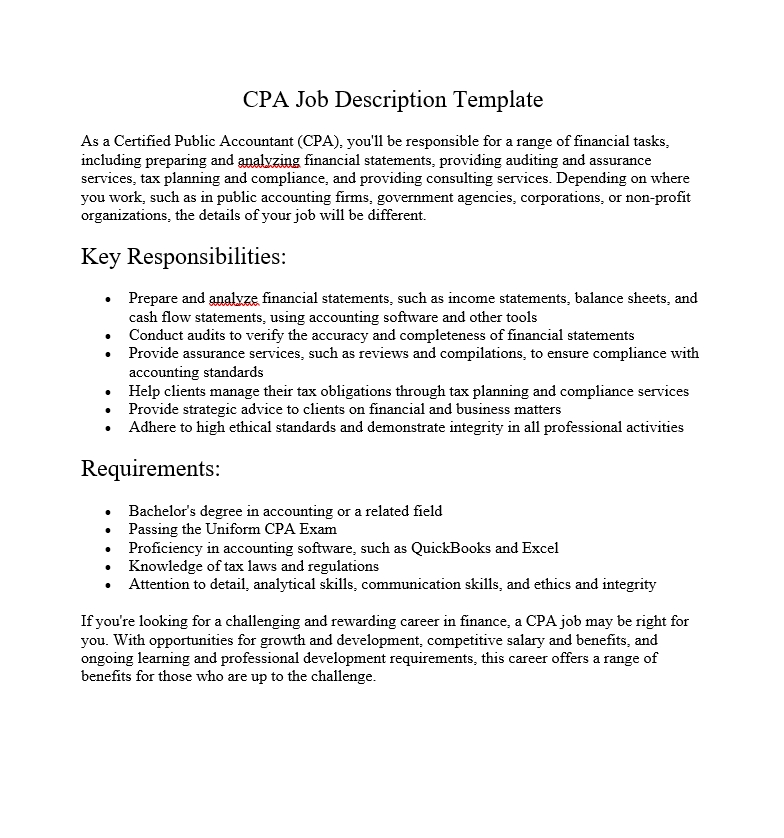

CPA Job Description Template

As a Certified Public Accountant (CPA), you’ll be responsible for a range of financial tasks, including preparing and analyzing financial statements, providing auditing and assurance services, tax planning and compliance, and providing consulting services. Depending on where you work, such as in public accounting firms, government agencies, corporations, or non-profit organizations, the details of your job will be different.

Key Responsibilities:

- Prepare and analyze financial statements, such as income statements, balance sheets, and cash flow statements, using accounting software and other tools

- Conduct audits to verify the accuracy and completeness of financial statements

- Provide assurance services, such as reviews and compilations, to ensure compliance with accounting standards

- Help clients manage their tax obligations through tax planning and compliance services

- Provide strategic advice to clients on financial and business matters

- Adhere to high ethical standards and demonstrate integrity in all professional activities

Requirements:

- Bachelor’s degree in accounting or a related field

- Passing the Uniform CPA Exam

- Proficiency in accounting software, such as QuickBooks and Excel

- Knowledge of tax laws and regulations

- Attention to detail, analytical skills, communication skills, and ethics and integrity

If you’re looking for a challenging and rewarding career in finance, a CPA job may be right for you. With opportunities for growth and development, competitive salary and benefits, and ongoing learning and professional development requirements, this career offers a range of benefits for those who are up to the challenge.

Q: What is a CPA job?

A Certified Public Accountant (CPA) is a financial expert who prepares and analyzes financial statements, does audits and assurance services, helps with tax planning and compliance, and provides consulting services. CPAs can find work in a wide range of industries, from public accounting firms and government agencies to corporations and nonprofits.

What exactly does a CPA do?

Certified Public Accountants (CPAs) in a certain industry must do things like prepare and analyze financial statements, perform audits, provide assurance services, help clients manage their tax obligations, give clients strategic advice on financial and business matters, and follow high ethical standards and act with integrity in all professional activities.