Collections Manager Job: Duties, Requirements, and Responsibilities

Collections Manager Job DescriptionThe Collections Manager is in charge of keeping accurate records of all collection activities, including information about debtors, amounts owed, and efforts to collect.

Overview of Collections Manager Role

The Collections Manager is responsible for managing the organization’s debt collection process. The role involves the development and implementation of strategies to improve the collections process, ensuring compliance with regulations and policies, and maintaining customer relations. Collections Manager is responsible for leading and supervising a team of collections agents, ensuring that the team performs effectively and efficiently.

Duties and Responsibilities

Debt Collection

Debt collection is one of the most critical responsibilities of a Collections Manager. The manager must come up with and use effective ways to collect debts that reduce the risk of bad debts and get the most money back. The manager must also ensure that the collections process complies with relevant regulations and policies.

Reporting and Record-Keeping

Proper reporting and record keeping are critical in debt collection. The manager must also prepare regular reports for senior management to track collections performance.

Customer Service

Customer service is an essential part of the debt collection process. Collections Manager must ensure that customer relations are maintained during the collections process. The manager must also come up with ways to deal with difficult customers and settle disagreements well.

Team Management

The Collections Manager is responsible for leading and supervising a team of collection agents. The manager must ensure that the team performs effectively and efficiently. The manager must also come up with training programs to improve the skills and knowledge of the team and make sure that the team follows all laws and rules.

Qualifications and Requirements

Educational Qualifications

Collections Manager positions typically require a bachelor’s degree in a relevant field, such as accounting, finance, or business administration. However, some organizations may accept equivalent work experience in lieu of formal education.

Technical Skills

Collections Manager requires technical skills in debt collection, reporting, record keeping, and team management. The manager must also have experience working with collections software and databases.

Soft Skills

Collections Manager requires soft skills such as effective communication, leadership, problem-solving, and critical thinking. The manager must also be able to deal with difficult customers and have great customer service skills.

Experience

Collections Manager typically requires several years of experience in debt collections, preferably in a supervisory or managerial role. The manager must also have experience leading teams and coming up with and putting into place plans for collecting debts.

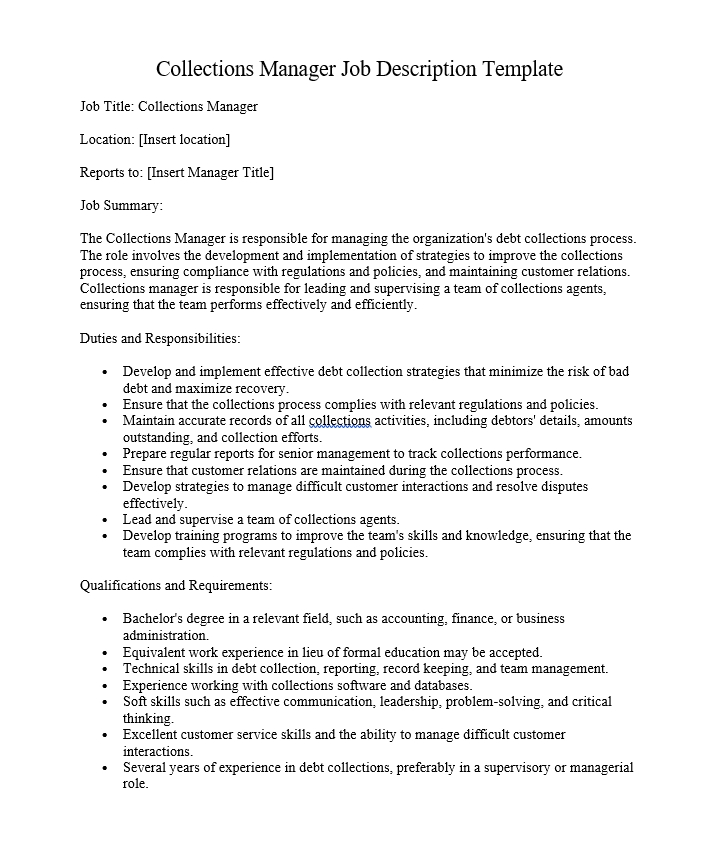

Collections Manager Job Description Template

Job Title: Collections Manager

Location: [Insert location]

Reports to: [Insert Manager Title]

Job Summary:

The Collections Manager is responsible for managing the organization’s debt collections process. The role involves the development and implementation of strategies to improve the collections process, ensuring compliance with regulations and policies, and maintaining customer relations. Collections manager is responsible for leading and supervising a team of collections agents, ensuring that the team performs effectively and efficiently.

Duties and Responsibilities:

- Develop and implement effective debt collection strategies that minimize the risk of bad debt and maximize recovery.

- Ensure that the collections process complies with relevant regulations and policies.

- Maintain accurate records of all collections activities, including debtors’ details, amounts outstanding, and collection efforts.

- Prepare regular reports for senior management to track collections performance.

- Ensure that customer relations are maintained during the collections process.

- Develop strategies to manage difficult customer interactions and resolve disputes effectively.

- Lead and supervise a team of collections agents.

- Develop training programs to improve the team’s skills and knowledge, ensuring that the team complies with relevant regulations and policies.

Qualifications and Requirements:

- Bachelor’s degree in a relevant field, such as accounting, finance, or business administration.

- Equivalent work experience in lieu of formal education may be accepted.

- Technical skills in debt collection, reporting, record keeping, and team management.

- Experience working with collections software and databases.

- Soft skills such as effective communication, leadership, problem-solving, and critical thinking.

- Excellent customer service skills and the ability to manage difficult customer interactions.

- Several years of experience in debt collections, preferably in a supervisory or managerial role.

Q: What is a Collections Manager?

A: A Collections Manager is responsible for managing the organization’s debt collections process. This means coming up with and putting into action effective ways to collect debts, keeping accurate records, making sure rules and policies are followed, keeping good relationships with customers, and leading and supervising a team of collections agents.

Q: What are the key responsibilities of a Collections Manager?

A: The key responsibilities of a Collections Manager include developing and implementing debt collection strategies, maintaining accurate records, ensuring compliance with regulations and policies, maintaining customer relations, and leading and supervising a team of collections agents.

Q: What skills are required to be a Collections Manager?

A: The skills required to be a Collections Manager include technical skills in debt collection, reporting, record keeping, and team management, as well as soft skills such as effective communication, leadership, problem-solving, and critical thinking. It’s also important to have good customer service skills and know how to deal with difficult customers.

Q: What qualifications are required to be a Collections Manager?

A: A bachelor’s degree in a relevant field, such as accounting, finance, or business administration, is usually required to become a Collections Manager. Equivalent work experience in lieu of formal education may also be accepted. You also need to have worked in debt collection for a few years, preferably in a supervisory or managerial role.

Q: What are the challenges of being a Collections Manager?

A: The challenges of being a Collections Manager include managing difficult customer interactions, developing and implementing effective debt collection strategies, maintaining compliance with regulations and policies, and leading and supervising a team of collections agents. The job can be demanding and stressful, and it requires a high level of attention to detail and the ability to work under pressure.

Q: What are the benefits of being a Collections Manager?

A: The benefits of being a Collections Manager include a competitive salary, opportunities for career advancement, and the ability to develop and implement effective debt collection strategies that maximize recovery and minimize the risk of bad debt. The job also provides opportunities to lead and supervise a team of collections agents, develop training programs, and work in a challenging and dynamic environment.

Q: How can I become a Collections Manager?

A: To become a Collections Manager, you should obtain a bachelor’s degree in a relevant field, such as accounting, finance, or business administration, and gain several years of experience in debt collections, preferably in a supervisory or managerial role. It is also important to learn both hard and soft skills in areas like collecting debts, reporting, keeping records, and managing a team. To improve your knowledge and skills, you can also get professional certifications in debt collection.