Tax Auditor Job Description

Roles and Responsibilities

Depending on the company they work for and the type of audit being done, tax auditors have different roles and responsibilities. Generally, tax auditors:

- Review tax returns and financial records to identify discrepancies

- Conduct audits of individuals and businesses

- Collect and analyze data

- Prepare detailed reports of findings

- Advise clients on tax issues and compliance with tax laws and regulations

Work Environment

Tax auditors usually work in an office, but some may have to travel to do audits in person. They may work for government agencies, accounting firms, or other organizations.

Tax Auditor Responsibilities

Conducting Audits

The primary responsibility of tax auditors is to conduct audits of individuals and businesses. This involves reviewing tax returns and financial records, collecting data, and analyzing information to ensure compliance with tax laws and regulations.

Analyzing Data

Tax auditors also need to be able to look for differences and possible places where laws aren’t being followed. They review financial records, identify patterns, and conduct statistical analyses to detect inconsistencies.

Preparing Reports

After an audit is done, tax auditors have to write up a report of what they found. The report must be complete and accurate, pointing out any differences or possible places where rules aren’t being followed.

Tax Auditor Requirements and Skills

Education and Training

Most tax auditors hold a bachelor’s degree in accounting, finance, or a related field. To specialize in tax auditing, they may also need to get more training or a certificate.

Technical Skills

Tax auditors must have a strong understanding of tax laws and regulations, as well as accounting and financial principles. They must also be proficient in using accounting software and other technology.

Analytical Skills

Analytical skills are essential for tax auditors, as they must be able to analyze complex financial data and identify discrepancies or potential areas of noncompliance.

Communication Skills

Tax auditors must have strong communication skills, as they must be able to explain complex tax issues to clients and colleagues. They must also be able to write detailed reports and make presentations.

A tax auditor’s job is to look over tax returns and financial records to make sure that tax laws and rules are being followed. They analyze data, conduct audits of individuals and businesses, and prepare detailed reports of findings. Tax auditors need to be good at analyzing things, know a lot about tax laws and rules, and be able to talk to people well.

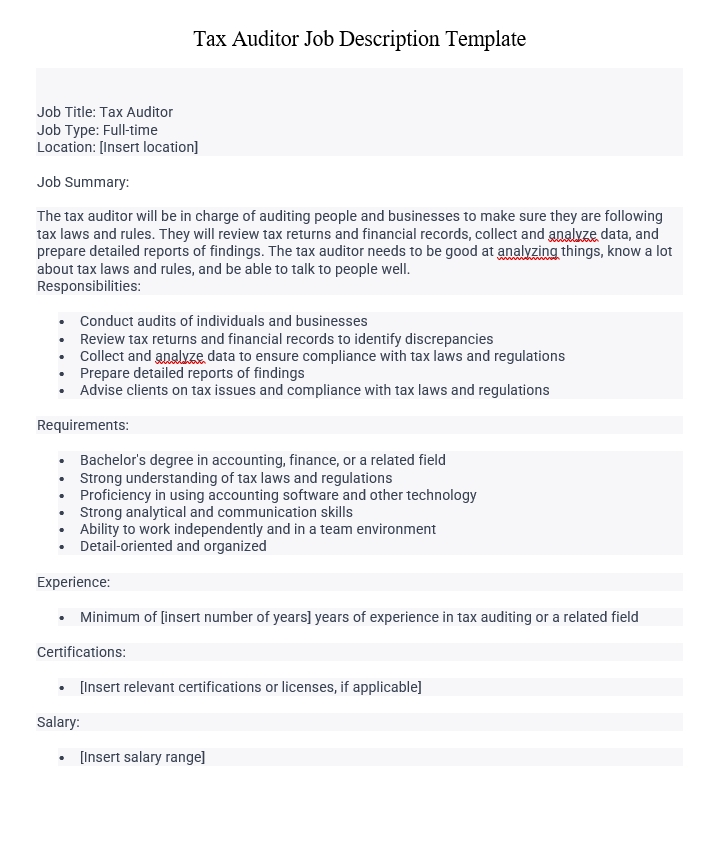

Job Title: Tax Auditor

Job Type: Full-time

Location: [Insert location]

Job Summary:

The tax auditor will be in charge of auditing people and businesses to make sure they are following tax laws and rules. They will review tax returns and financial records, collect and analyze data, and prepare detailed reports of findings. The tax auditor needs to be good at analyzing things, know a lot about tax laws and rules, and be able to talk to people well.

Responsibilities:

- Conduct audits of individuals and businesses

- Review tax returns and financial records to identify discrepancies

- Collect and analyze data to ensure compliance with tax laws and regulations

- Prepare detailed reports of findings

- Advise clients on tax issues and compliance with tax laws and regulations

Requirements:

- Bachelor’s degree in accounting, finance, or a related field

- Strong understanding of tax laws and regulations

- Proficiency in using accounting software and other technology

- Strong analytical and communication skills

- Ability to work independently and in a team environment

- Detail-oriented and organized

Experience:

- Minimum of [insert number of years] years of experience in tax auditing or a related field

Certifications:

- [Insert relevant certifications or licenses, if applicable]

Salary:

- [Insert salary range]

Here are some frequently asked questions about tax auditor jobs:

Q: What does a tax auditor do?

A: A tax auditor is responsible for conducting audits of individuals and businesses to ensure compliance with tax laws and regulations. They look at tax returns and financial records, collect and analyze data, and write detailed reports of what they find. They also advise clients on tax issues and compliance with tax laws and regulations.

Q: What are the qualifications for becoming a tax auditor?

A: You need at least a bachelor’s degree in accounting, finance, or a related field to become a tax auditor. Candidates must know a lot about tax laws and rules, be good at using accounting software and other types of technology, and have strong analytical and communication skills. Experience in tax auditing or a related field is also preferred.

Q: What are the job prospects for tax auditors?

A: The job prospects for tax auditors are positive, as the demand for tax compliance and regulation continues to increase. The Bureau of Labor Statistics projects a 6% increase in employment of accountants and auditors from 2018 to 2028.

Q: What industries hire tax auditors?

A: Tax auditors may be employed by government agencies, accounting firms, or private corporations. Tax auditors are often hired by the government, finance and insurance companies, professional services, and manufacturing companies.

Q: What skills are required to be a successful tax auditor?

A: Successful tax auditors possess strong analytical skills, attention to detail, and the ability to work independently and in a team environment. They must also have excellent communication skills, as they often need to explain complex tax issues to clients.

Q: What is the salary range for tax auditors?

A: The salary range for tax auditors varies depending on experience, location, and industry. According to the Bureau of Labor Statistics, the median annual wage for accountants and auditors was $73,560 in May 2019. However, salaries can range from $50,000 to over $120,000 per year, depending on the specific job and location.

Q: What are some challenges of being a tax auditor?

A: Some challenges of being a tax auditor include keeping up with changing tax laws and regulations, dealing with difficult clients, and managing a heavy workload during tax season. Tax auditors must also be able to handle stress and work well under pressure.