A Guide to Becoming a Budget Analyst: Job Description, Responsibilities, and Requirements

A budget analyst’s job is to create and manage budgets, look at financial information, and make budget suggestions. They work closely with department managers to make sure budgets are made and kept in line with the goals and rules of the organization. Budget analysts are also responsible for forecasting future budget needs and identifying budget variances.

Budget Analyst Responsibilities:

To be a successful budget analyst, you will need to:

- Develop and Use Budgeting Processes: This means making and using budgeting procedures and guidelines that will help the organization make budgets that are accurate and useful.

- Prepare budget reports and forecasts: Budget analysts must be able to make detailed reports and forecasts that accurately show how the organization’s money is doing.

- Analyze Financial Data to Identify Budget Variances: This involves analyzing financial Budget budget Adjustments: Based on their analysis of financial data and collaboration with department managers, budget analysts will make recommendations for budget adjustments that will help the organization meet its goals.

- Track expenses and keep an eye on spending: Budget analysts are in charge of keeping track of expenses and keeping an eye on spending to make sure that budgets are being followed.

- Budget analysts have to make sure that all spending and budget proposals follow the rules and guidelines of the organization.

Budget Analyst Requirements and Skills:

To become a budget analyst, you will need:

- Qualifications: Usually, you need a bachelor’s degree in finance, accounting, or a similar field. Some employers may require a master’s degree.

- Relevant Work Experience: Most employers want at least 2–3 years of experience in budget analysis, finance, or accounting.

- Technical and analytical skills: Budget analysts need to be good at Excel, financial modeling, and data analysis, among other things. They also need to be able to use their technical and analytical skills well.

- Communication and people skills: Budget analysts need to be able to talk to department managers and other important people and work well in a team setting.

- Paying Attention to Details and Being Accurate: Budget analysts need to pay attention to details and be able to keep their work accurate.

How to Become a Budget Analyst

To become a budget analyst, you will need to:

- Education and Certification Requirements: Usually, you need a bachelor’s degree in finance, accounting, or a similar field. Some employers may require a master’s degree. Certifications, such as the Certified Government Financial Manager (CGFM) or the Certified Management Accountant (CMA), can also be helpful.

- Skills and Qualifications To be a good budget analyst, you need to have good technical and analytical skills, good communication and people skills, attention to detail, and accuracy.

- Budget analysts can work in many different fields, such as healthcare, government, non-profits, and private companies. There are also opportunities for career growth, including management positions and other leadership roles.

- A budget analyst is an important part of any organization because they make sure that budgets are made, managed, and kept in line with the organization’s goals and rules. Here is a sample job description for a budget analyst that can be changed to fit the needs of your organization.

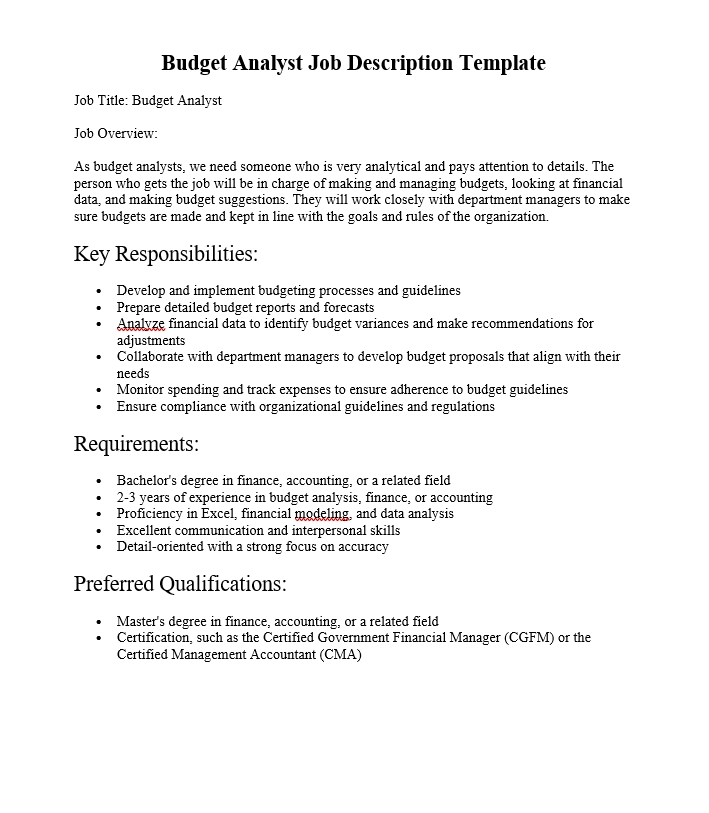

Budget Analyst Job Description Template

Job Title: Budget Analyst

Job Overview:

As budget analysts, we need someone who is very analytical and pays attention to details. The person who gets the job will be in charge of making and managing budgets, looking at financial data, and making budget suggestions. They will work closely with department managers to make sure budgets are made and kept in line with the goals and rules of the organization.

Key Responsibilities:

- Develop and implement budgeting processes and guidelines

- Prepare detailed budget reports and forecasts

- Analyze financial data to identify budget variances and make recommendations for adjustments

- Collaborate with department managers to develop budget proposals that align with their needs

- Monitor spending and track expenses to ensure adherence to budget guidelines

- Ensure compliance with organizational guidelines and regulations

Requirements:

- Bachelor’s degree in finance, accounting, or a related field

- 2-3 years of experience in budget analysis, finance, or accounting

- Proficiency in Excel, financial modeling, and data analysis

- Excellent communication and interpersonal skills

- Detail-oriented with a strong focus on accuracy

Preferred Qualifications:

- Master’s degree in finance, accounting, or a related field

- Certification, such as the Certified Government Financial Manager (CGFM) or the Certified Management Accountant (CMA)

Q: What are the benefits of being a budget analyst?

A: Being a budget analyst offers the opportunity to play a critical role in an organization’s financial health, as well as the chance to work with department managers and other stakeholders to make important financial decisions. This role also gives you the chance to learn financial analysis, data management, and project management skills.

Q: What are the challenges of being a budget analyst?

A: Some of the challenges of being a budget analyst are balancing different priorities and needs, navigating complex organizational structures and financial systems, and working with stakeholders who may have different opinions or priorities. But these problems can be solved with strong analytical skills, careful attention to detail, and good communication.

Q: What career paths are available for a budget analyst?

A: A budget analyst can progress to roles such as financial manager, senior budget analyst, or financial director. They could also choose to specialize in something like budgeting for the government or a non-profit. Also, the skills you learn as a budget analyst can be used in other areas of finance or business, which can help you grow and advance in your career.